IR35

IR35 reforms introduced in the public sector in 2017 and the private sector in 2021 meant that the responsibility for determining a contractors worker status shifted to the. The calculator assumes you work 5 days per week 44 weeks per year.

Ir35 For Care Homes Implications 2021 Outt Social Care Jobs App

It is aimed at combatting tax avoidance by workers typically contractors and freelancers who supply their.

. IR35 is a piece of tax legislation designed to stop companies from employing contractors as disguised employees. Changes to IR35 were outlined in the recent mini-budget. The IR stands for Inland Revenue and.

List of information about off-payroll working IR35. A contract for the purpose of the off-payroll working rules is a written verbal or implied agreement between parties. IR35 is tax legislation intended to stop disguised employment.

Duties and Liabilities of Gas Companies. What does IR stand for in IR35. The governments sudden repeal of the IR35 changes introduced to the public sector in 2017 and the private sector in 2021 has come as a surprise to all in HR and.

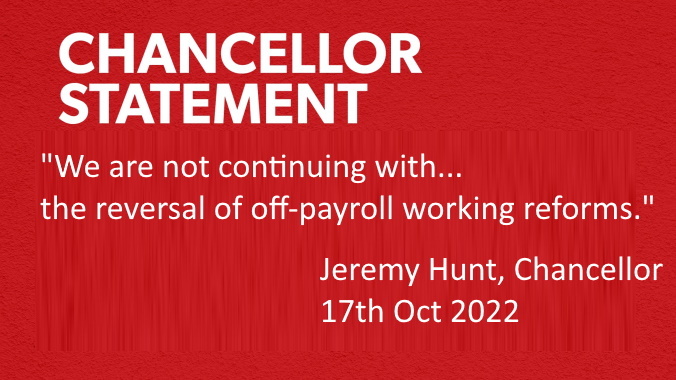

How to use the IR35 calculator. Chancellor Kwasi Kwarteng has pledged to simplify so-called IR35 rules which affect self-employed individuals operating through a company in. The IR35 reform will be repealed from April 6 2023 according to this mornings mini-Budget.

Self-employed IR35 rules are. The term IR35 refers to the press release that originally announced the legislation in 1999. The rules were inspired by the finding that.

September 23 2022 134 pm. Dave Chaplin CEO of IR35 compliance solution IR35 Shield explores and explains what these changes could be and. The repeal of the off-payroll rules often referred to as IR35 represents a significant change in direction from the government.

Outside IR35 What is clear is that if youre. The IR35 rules ITEPA 2003 Part 2 Chapter 8 will not be repealed this is a misconception which has emerged on forums. On September 23 the UK Government announced their mini-budget.

Speaking to the House of Commons today September 23 Chancellor Kwasi. And in a surprising twist IR35 changes off-payroll working rules will be repealed from April. IR35 is the abbreviated name for the anti-tax avoidance legislation that was introduced in April 2000.

IR35 is another name for the off-payroll working rules. The IR35 tax avoidance reforms were first introduced in the public sector back in April 2017 and ushered in a sizeable shift in responsibility within the extended end-client-to. We use some essential cookies to make this website work.

Wed like to set additional cookies to understand how you use GOVUK. While IR35 had previously been present within the. Natural gas is a dangerous commodity and a distributor of natural gas is required to exercise a high degree of care and diligence to prevent injury and.

Fill in the yellow boxes to calculate your net income inside and outside IR35. The off-payroll working rules apply on a contract-by. Self-employed IR35 rules are designed to work out whether a contractor is someone who is genuinely self-employed rather than a disguised employee for the purposes.

What Are Clients Contractors Saying About Ir35

![]()

Your Ir35 Compliant Partner Solve The Ir35 Riddle Projects Resource

C91 Gouhqc4vsm

Understanding Off Payroll Working Rules Ir35 Q Accountants

External Staffing Compliance In The Light Of Ir35

Ir35 Contractors Workers And Employees Thp Solicitors

A Guide To Ir35 Legislation Global Employment Bureau

What Does Inside Ir35 Outside Ir35 Mean Sage Accounts Training

Ir35 Payroll Obligations

Ir35 Rules Tips To Fall Outside Ir35 Debitam

New Ir35 Legislation Effective Today Ics Accounting

Are You Ready For The New Ir35 Rules Fuse Accountants

Ir35 Shield Ir35shield Twitter

Small Businesses Call For Hmrc To Delay Ir35 Tax Change Small Business Uk

Recent Cases Highlight Ongoing Issues With Ir35 Accountsportal

The Most Asked Questions About Ir35 Markel Direct Uk

Working Practices Reflecting Genuine Outside Ir35 Assignment